Notation & Blockchain Participation

Topics:

Tl’dr — Check out our deck on “Blockchain Participation” from our most recent annual meeting.

Notation hosted its second annual LP meeting a couple of months ago, and as usual, we published our deck. In addition to the typical annual meeting topics such as fund performance and portfolio company reviews, we decided to do a few deep dives into specific areas of current interest. In particular, we’ve been investing and participating in the Blockchain space for a few years now. We have been deeply involved at the earliest stages with Livepeer, Bison Trails, Arwen and others — so we figured it might be interesting to go deep on what ‘blockchain participation’ really means to us from a venture perspective.

You can find the deck that we used here, and our learnings below. We hope that by sharing our thinking, we’ll hear additional perspectives from the community, and we expect our views on this space will continue to evolve in the years to come.

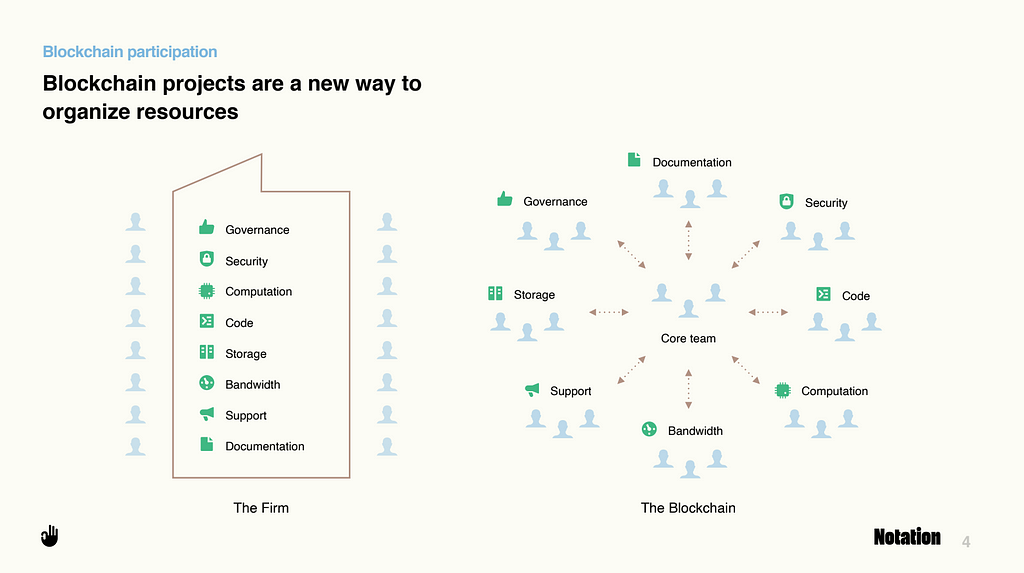

We see blockchain companies as a new way to organize the traditional “firm.” Many of the decentralized protocols and apps that are being created today are also employing a fundamentally new approach to their corporate structure. One simple way to think about many crypto projects is to view them through the lens of open source development. No single person or corporate entity owns the Bitcoin or Ethereum network, for example. These protocols are built and maintained by foundations, similar to Linux, and kept running by a network of decentralized nodes all over the world.

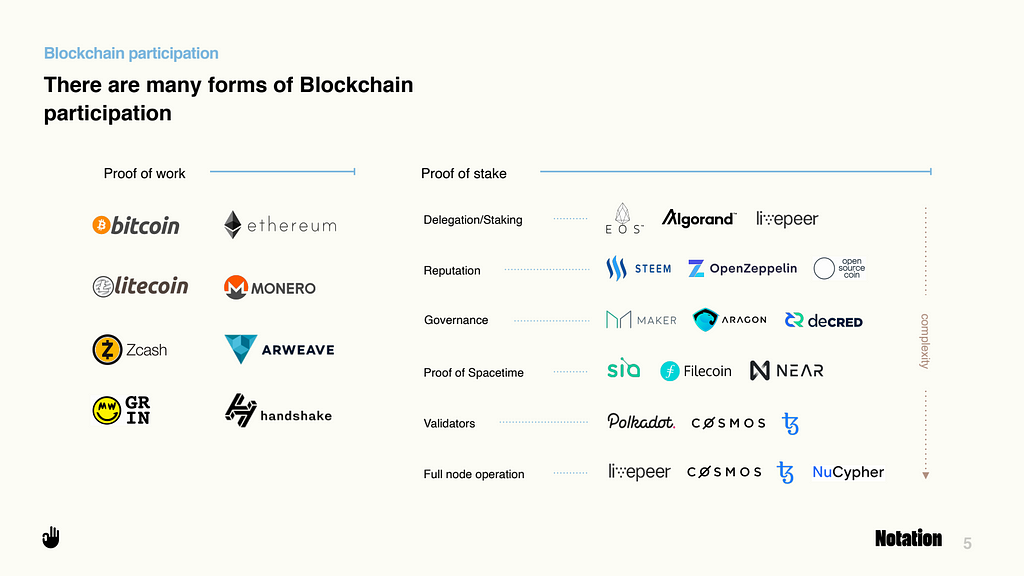

As open source projects, anyone can participate in these new and disruptive networks. As seen from the chart below, participating takes many forms — Contributing code, computing power, community support and governance, providing early capital, marketing, among many other forms.

One way to categorize the types of participation is in “proof of work” versus “proof of stake,” but often each crypto network has its own unique mechanisms that look a little different. For example, proof of stake participation may be primarily done via governance, full node operations, and staking. As a network participant, it’s crucial to understand these nuances, but it takes real time and commitment to do so in a meaningful way.

As VCs, we’re conscious of the time and effort it takes to particulate in crypto networks, but over the last couple years, we’ve found that active participation can really move the needle for returns, and often leads to better outcomes than passive investing, even accounting for the additional investment of time. We’re not alone in this thinking — our friends at Cambrial Capital also found that the first few months of validating on a network is likely more profitable than many years in aggregate after the network has matured.

We believe network participation is still in its infancy, but given our experiments to date and our technical and operational DNA, we very much expect to expand our capabilities here in the years to come. Our plan is to be as active participants as we are investors in the next generation of core Blockchain protocols.

Big things to come in 2020 on that front… so stay tuned 🙂

Cheers,

Alex, Nick, Katherine, Thomas

PS as always, we are at hello@notation.vc – feel free to visit us at notation.vc or say hi on twitter!

Notation & Blockchain Participation was originally published in Notation on Medium, where people are continuing the conversation by highlighting and responding to this story.